Programa de Rescate Hipotecario de California

Awarded 37,000+ Grants to California Families in Need

No Longer Accepting Applications

¿Qué es el Programa de Rescate Hipotecario de California?

The California Mortgage Relief Program provided grants to thousands of homeowners who faced financial hardships as a result of the Covid-19 pandemic. Funded by the federal government, the program helped vulnerable homeowners get a fresh start.

Eligible homeowners received grants to help cover past-due mortgage payments, missed property taxes, partial claims/loan deferrals, reverse mortgages, and PACE loans.

California received an allocation from the American Rescue Plan Act’s (ARPA) Homeowner Assistance Fund and administered these federal funds with a focus on socially disadvantaged households.

Help for Homeowners

The California Mortgage Relief Program is no longer offering grants. Homeowners who need support are encouraged to contact a HUD-certified housing counselor.

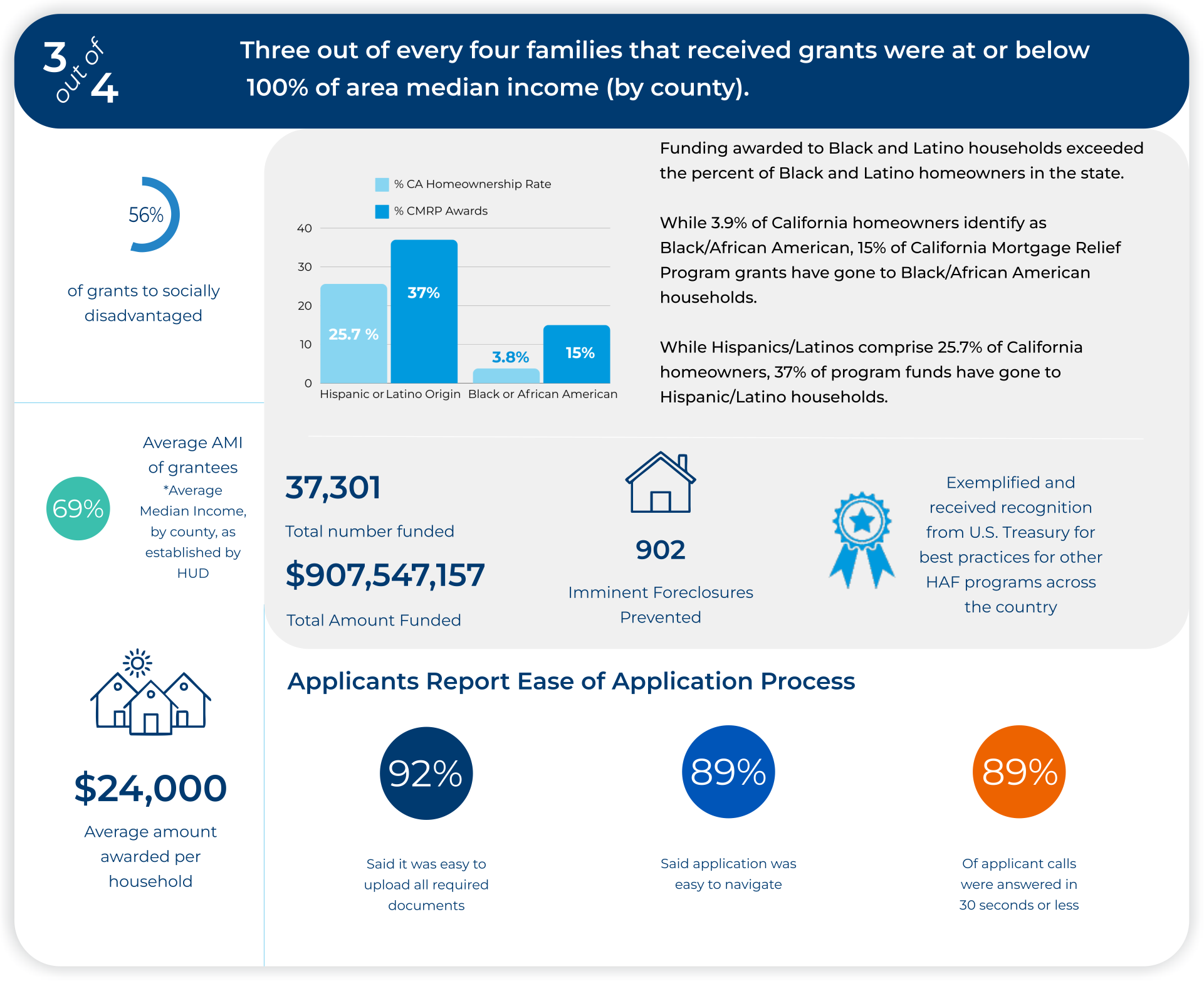

Estadísticas del Programa

The California Mortgage Relief Program provided more than $900 million in critical housing assistance to over 37,000 California households to protect their homes. The program adapted to changing market conditions, expanded the types of assistance available to homeowners and provided resources and support to help homeowners navigate the application process.

Grant Award Demographics

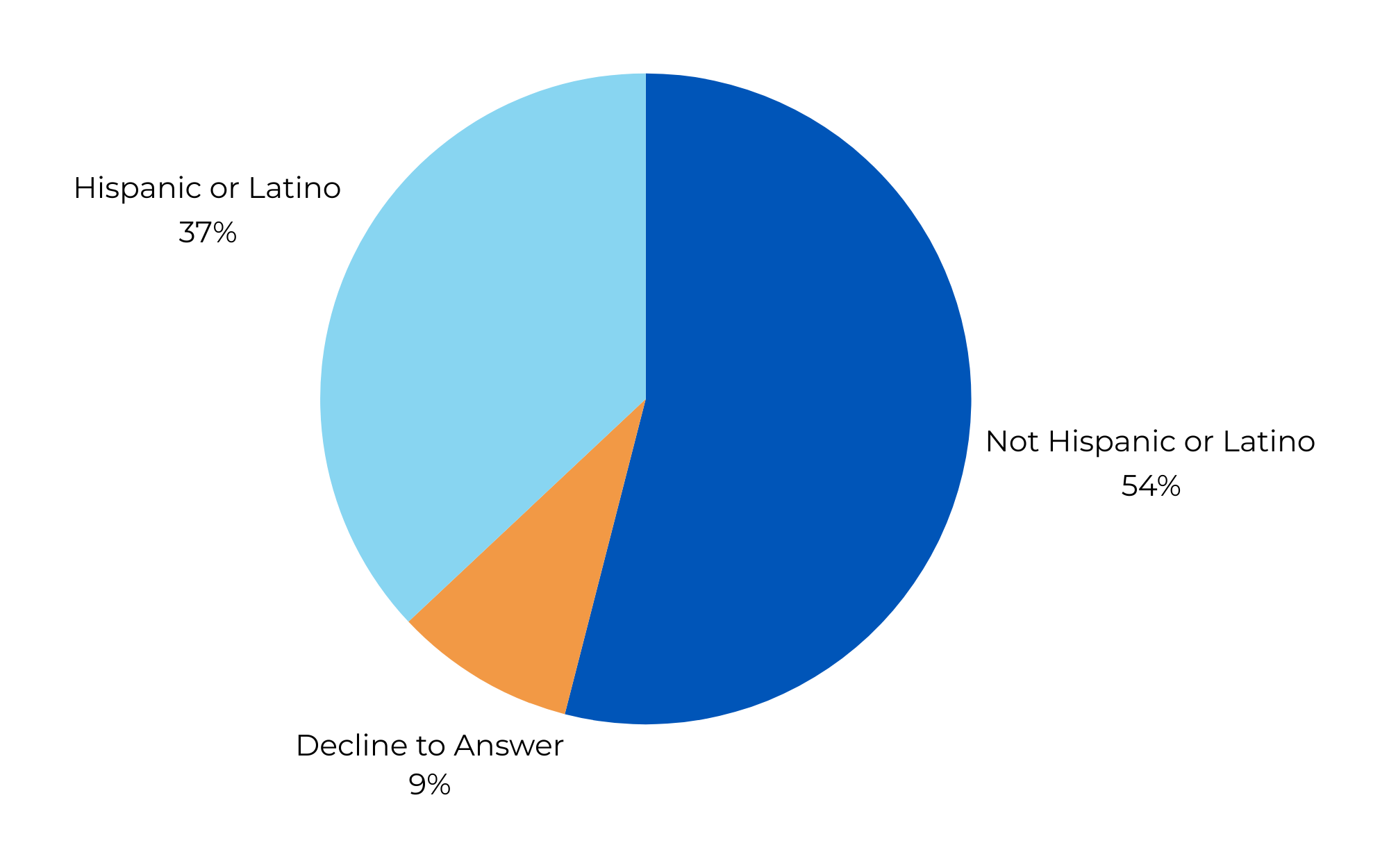

Ethnicity - Etnia

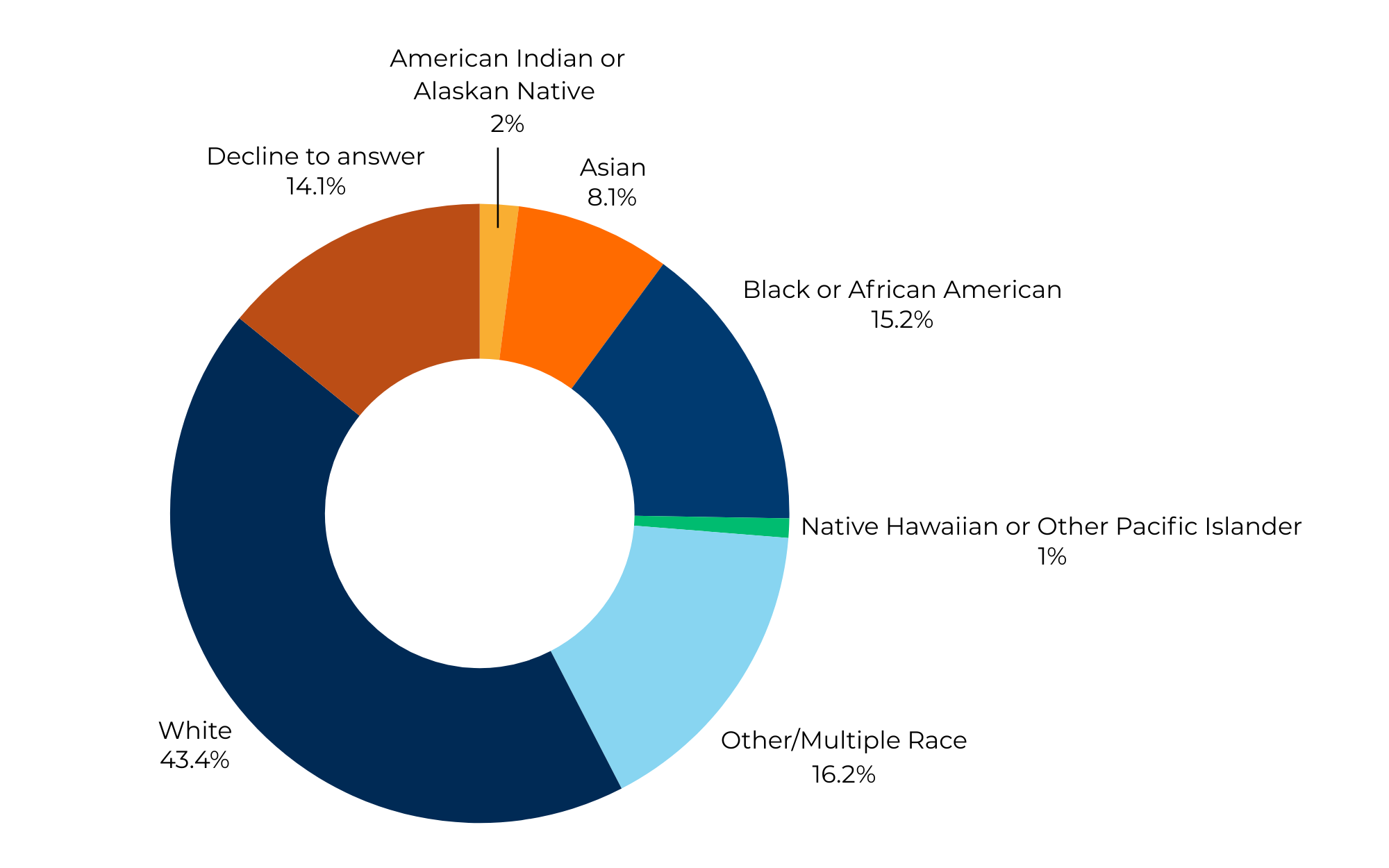

Race - Raza

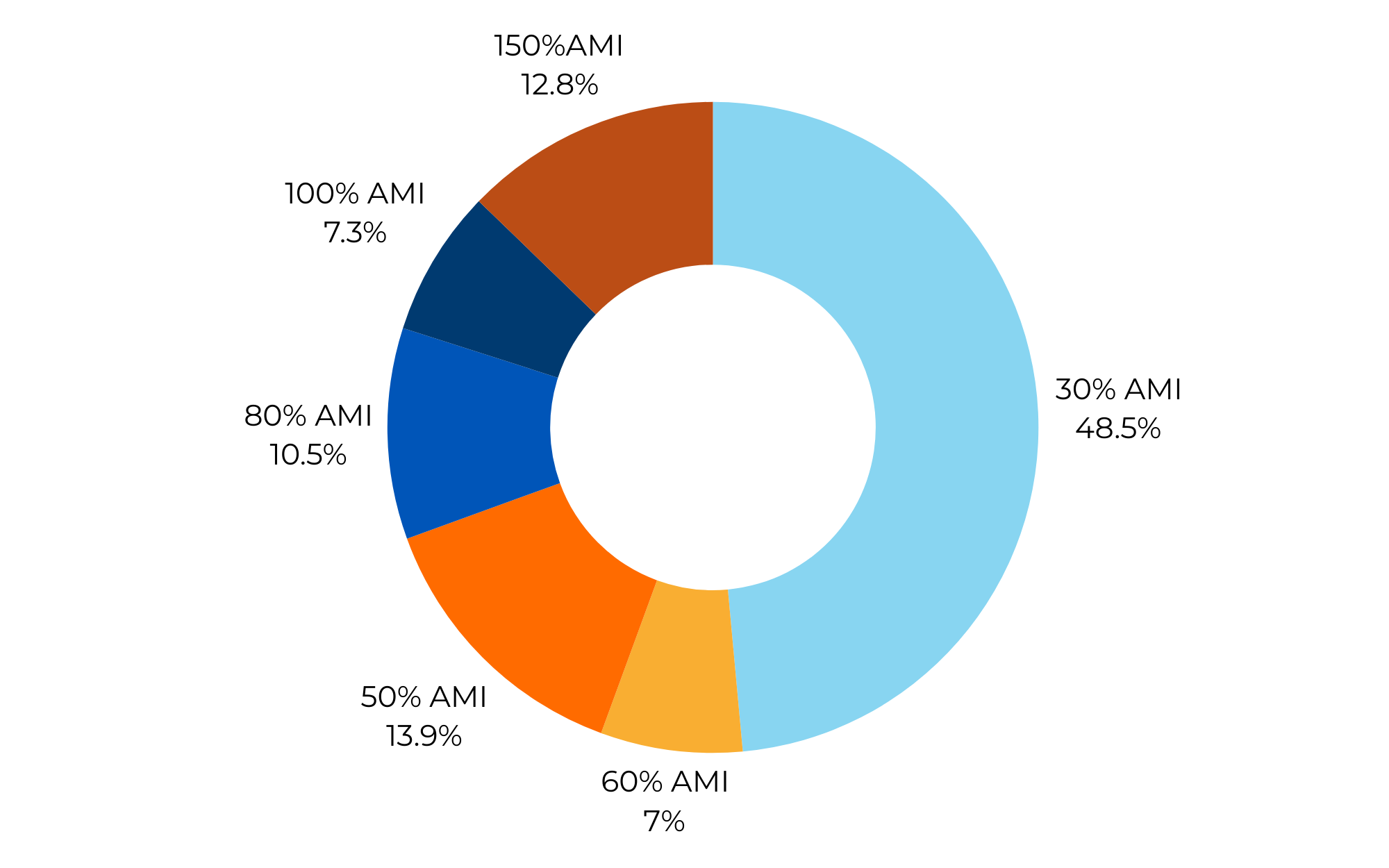

Household Income as a % of Area Median Income (AMI)

County Data

Data Driven Results

- Data-driven outreach, focused program design, close partnerships with community organizations, and consumer advocates ensured that the most high-risk and vulnerable populations had the opportunity to apply.

- This effort underscores California’s commitment to equity and transparency in providing relief to those most in need.

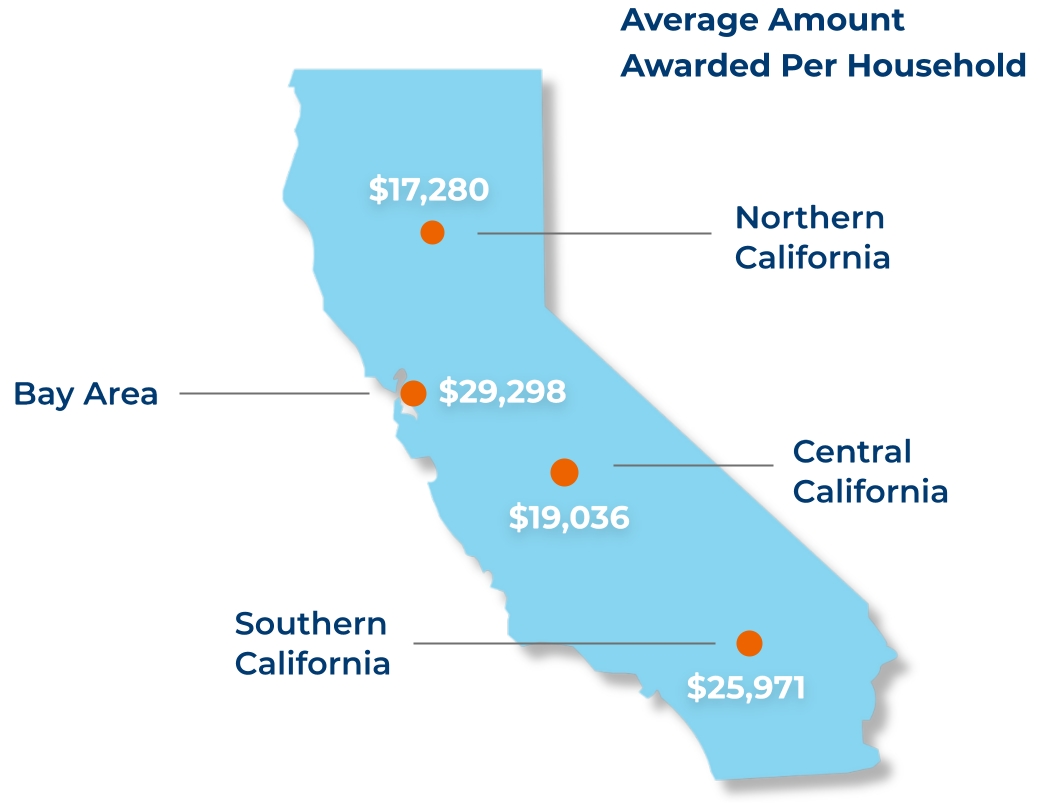

- The average award amounts for the California Mortgage Relief Program reveal significant regional variations in housing costs. In regions like the Bay Area and Southern California, where housing is more expensive, the average awards are higher, reflecting the greater financial assistance needed to support homeowners in these high-cost areas.

“California’s Mortgage Relief Program has made a huge impact in underserved communities where families were in danger of losing their homes or hard-earned equity.”

– Stacey Tutt, Homeowner Assistance Fund Coordinator and Senior Staff Attorney at the National Housing Law Project.

Stories Directly from Homeowners

The California Mortgage Relief Program awarded more than 37,000 grants to homeowners. Read their stories below.

Central Valley

“I was very surprised by the easy process and quick responses I received. It was a blessing to have the funds paid directly to the mortgage company and in a timely and efficient manner. Thank you so much!”

– Ana

Homeowner

San Joaquin County

“Initially, I didn’t believe it would happen for me. I have worked all my life for everything I need and have without getting anything for free. I am just so grateful for the assistance. I have no idea how else to get the funds I needed to keep my home.”

– Sylvia

Homeowner

Sacramento County

Southern California

“I was days away from the foreclosure sale. You gave me my life back and allowed me the chance to keep the home that I have lived in for 23 years. I am so grateful to everyone there. God bless you all and reward you for the work you do. You save lives and you change lives. I am proof!!!”

– Maurice

Homeowner

Los Angeles County

“I am so relieved, pleased and grateful for your assistance. This has taken a huge weight off my shoulders and is the reset that I needed. I appreciate the much-needed help to get current and to stay in my home.”

– Tony

Homeowner

Los Angeles County

Bay Area

“The California Mortgage Relief Program provided me with the ability to continue creating memories and sharing traditions with my friends and family. The funding allowed me the ability to get back on solid ground so that I can continue the legacy that my parents gave to me. I am also rolemodeling the value of homeownership for my nieces and nephews.”

– Lisa

Homeowner

Marin County

“I want to thank the entire team at CA Mortgage Relief that helped my husband and me keep our house! It is truly amazing the work you are doing to help folks like us, that were wrecked by the COVID disaster and recession, keep our home. It is truly a miracle, so thank you all for your hard work from the bottom of our hearts!”

– Alison

Homeowner

Contra Costa County

CA Mortgage Relief Program In the News

News stories helped spread the word about the assistance available for homeowners.

Helping Homeowners: California Expands Mortgage Relief

CalMatters

Angela Morrow was only eight months into a new career as a flight attendant when she was laid off from her job due to the COVID-19 pandemic, putting her at risk of losing her three-bedroom, two-bathroom home in San Bernardino County.

Morrow, 63, said she was able to save her home in Bloomington through the $1 billion California Mortgage Relief Program, which enabled her to pay off more than $54,000 worth of mortgage debt — relief that lowered her monthly payments for the long-term.

California offers help for more homeowners who missed mortgage or tax payments

Los Angeles Times

“We’ve heard from Californians who initially didn’t believe this funding was real,” Rebecca Franklin, president of the CalHFA Homeownership Relief Corp., said in a statement. “And so many vulnerable homeowners who were able to save their home and continue building generational wealth for their families.”

“Now that we have crossed the halfway point, California homeowners should apply right away because these funds are limited,” Franklin added. “Over 20,000 homeowners have already gotten help with late mortgage payments, missed property taxes and partial claims loan deferrals taken during the pandemic.”

California to Help Homeowners Catch up on Mortgage Payments

The Sacramento Bee

SACRAMENTO, Calif. (AP) — California will help up to 40,000 homeowners catch up on their mortgage payments.

Gov. Gavin Newsom announced Monday the federal government approved his mortgage relief plan. California will use about $1 billion in federal money to help people who fell behind on their mortgage payments during the pandemic.

Only people who own and occupy one property and make at or below 100% of their area median income will be eligible. The program covers single-family homes, condos and manufactured homes. Owners also must attest they have faced a pandemic-related financial hardship after Jan. 21, 2020.

Angelino is saved from losing his home thanks to the California Mortgage Relief Program

La Opinion

When Los Angeles resident Eloy Anthony Garcia opened the City of Palms Springs website to check the status of his property tax debt on his home, he broke down in tears, unable to believe the debt was no longer there. “I almost fell to my knees when I realized I didn’t owe anything anymore,” says Eloy Anthony, excited as he recalls that thanks to the California Mortgage Rescue Program, his $12,000 property tax debt was now settled.

CalHFA Announces More Mortgage Relief for California Families

Black Voice News

Earlier this month, the California Housing Financing Agency (CalHFA) and the Sacramento branch of NeighborWorks held a press conference at the State Capitol to announce the expansion of California’s mortgage relief program.

“Over the past year, the California Mortgage Relief program has been helping Californians that are most vulnerable to overcome the financial challenges brought on by the COVID-19 pandemic,” said Tiena Johnson Hall, Executive Director of the California Housing Finance Agency.